Other latest reports

Visitors here can find an array of publications related to productivity, competitiveness, quality and economy released by different stakeholders. You may also visit the Archives section for past publications.

WEF Chief Economists Outlook January 2025

This briefing builds on the latest policy development research as well as consultations and surveys with leading chief economists from both the public and private sectors, organized by the World Economic Forum’s Centre for the New Economy and Society.

The outlook remains subdued, with a majority of chief economists (56%) expecting the global economy to weaken over the next year, compared to 17% anticipating improvement .

Expectations for global growth are muted overall but subject to significant regional divergence. The US economy is expected to deliver robust growth in 2025, and South Asia, particularly India, is also expected to maintain strong growth. The outlook for Europe remains gloomy, with 74% of respondents predicting weak or very weak growth this year. The outlook for China also remains weak, and growth is projected to slow gradually in the years ahead.

Global inflation is easing, with the International Monetary Fund (IMF) projecting an annual average of 4.3% in 2025, down from 5.8% in 2024. However, services inflation remains higher than goods inflation, particularly in advanced and emerging market economies. Moderate inflation is expected in most regions, but the uptick in the short-term outlook for growth in the US has been accompanied by a significant increase in inflation expectations, according to the chief economists

Click here to download the report.

World Economic Outlook Jan 2025

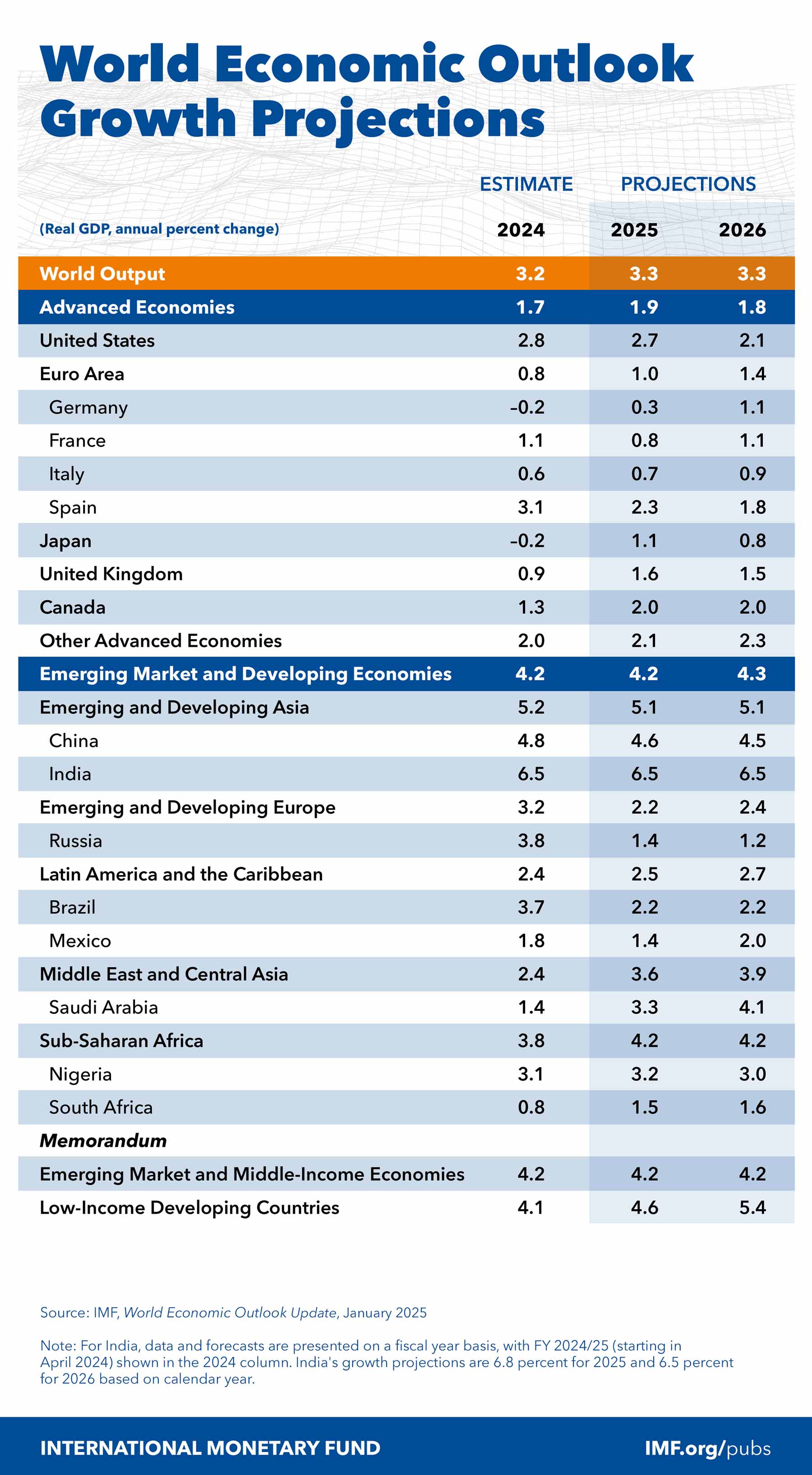

Global growth is projected at 3.3 percent both in 2025 and 2026, below the historical (2000–19) average of 3.7 percent. The forecast for 2025 is broadly unchanged from that in the October 2024 World Economic

Outlook (WEO), primarily on account of an upward revision in the United States offsetting downward revisions in other major economies. Global headline inflation is expected to decline to 4.2 percent in 2025 and to 3.5 percent in 2026, converging back to target earlier in advanced economies than in emerging market and developing economies.

Medium-term risks to the baseline are tilted to the downside, while the near-term outlook is characterized by divergent risks. Upside risks could lift already-robust growth in the United States in the short run, whereas risks in other countries are on the downside amid elevated policy uncertainty. Policy-generated disruptions to the ongoing disinflation process could interrupt the pivot to easing monetary policy, with implications for fiscal sustainability and financial stability. Managing these risks requires a keen policy focus on balancing trade-offs between inflation and real activity, rebuilding buffers, and lifting medium-term growth prospects through stepped-up structural reforms as well as stronger multilateral rules and cooperation.

Click here to download.

Global Risk Report 2025

The 20th edition of the Global Risks Report 2025 reveals an increasingly fractured global landscape, where escalating geopolitical, environmental, societal and technological challenges threaten stability and progress. This edition presents the findings of the Global Risks Perception Survey 2024-2025 (GRPS), which captures insights from over 900 experts worldwide. The report analyses global risks through three timeframes to support decision- makers in balancing current crises and longer-term priorities.

Click here to download the report.

The Future of Jobs Report 2025

Technological change, geoeconomic fragmentation, economic uncertainty, demographic shifts and the green transition – individually and in combination are among the major drivers expected to shape and transform the global labour market by 2030. The Future of Jobs Report 2025 brings together the perspective of over 1,000 leading global employers—collectively representing more than 14 million workers across 22 industry clusters and 55 economies from around the world—to examine how these macrotrends impact jobs and skills, and the workforce transformation strategies employers plan to embark on in response, across the 2025 to 2030 timeframe.

No alternative text description for this image

Key Findings

Broadening digital access is expected to be the most transformative trend – both across technology-related trends and overall – with 60% of employers expecting it to transform their business by 2030. Advancements in technologies, particularly AI and information processing (86%); robotics and automation (58%); and energy generation, storage and distribution (41%), are also expected to be transformative. These trends are expected to have a divergent effect on jobs, driving both the fastest-growing and fastest-declining roles, and fueling demand for technology-related skills, including AI and big data, networks and cybersecurity and technological literacy, which are anticipated to be the top three fastest- growing skills.

Increasing cost of living ranks as the second- most transformative trend overall – and the top trend related to economic conditions – with half of employers expecting it to transform their business by 2030, despite an anticipated reduction in global inflation. General economic slowdown, to a lesser extent, also remains top of mind and is expected to transform 42% of businesses. Inflation is predicted to have a mixed outlook for net job creation to 2030, while slower growth is expected to displace 1.6 million jobs globally. These two impacts on job creation are expected to increase the demand for creative thinking and resilience, flexibility, and agility skills.

Climate-change mitigation is the third-most transformative trend overall – and the top trend related to the green transition – while climate-change adaptation ranks sixth with 47% and 41% of employers, respectively, expecting these trends to transform their business in the next five years. This is driving demand for roles such as renewable energy engineers, environmental engineers and electric and autonomous vehicle specialists, all among the 15 fastest-growing jobs. Climate trends are also expected to drive an increased focus on environmental stewardship, which has entered the Future of Jobs Report’s list of top 10 fastest growing skills for the first time.

Two demographic shifts are increasingly seen to be transforming global economies and labour markets: aging and declining working age populations, predominantly in higher- income economies, and expanding working age populations, predominantly in lower-income economies. These trends drive an increase in demand for skills in talent management, teaching and mentoring, and motivation and self-awareness. Aging populations drive growth in healthcare jobs such as nursing professionals, while growing working-age populations fuel growth in education-related professions, such as higher education teachers.

Geoeconomic fragmentation and geopolitical tensions are expected to drive business model transformation in one-third (34%) of surveyed organizations in the next five years. Over one- fifth (23%) of global employers identify increased restrictions on trade and investment, as well as subsidies and industrial policies (21%), as factors shaping their operations. Almost all economies for which respondents expect these trends to be most transformative have significant trade with the United States and/or China. Employers who expect geoeconomic trends to transform their business are also more likely to offshore – and even more likely to re-shore – operations. These trends are driving demand for security related job roles and increasing demand for network and cybersecurity skills. They are also increasing demand for other human-centred skills such as resilience, flexibility and agility skills, and leadership and social influence.

Extrapolating from the predictions shared by Future of Jobs Survey respondents, on current trends over the 2025 to 2030 period job creation and destruction due to structural labour-market transformation will amount to 22% of today’s total jobs. This is expected to entail the creation of new jobs equivalent to 14% of today’s total employment, amounting to 170 million jobs. However, this growth is expected to be offset by the displacement of the equivalent of 8% (or 92 million) of current jobs, resulting in net growth of 7% of total employment, or 78 million jobs.

Frontline job roles are predicted to see the largest growth in absolute terms of volume and include Farmworkers, Delivery Drivers, Construction Workers, Salespersons, and Food Processing Workers. Care economy jobs, such as Nursing Professionals, Social Work and Counselling Professionals and Personal Care Aides are also expected to grow significantly over the next five years, alongside Education roles such as Tertiary and Secondary Education Teachers.

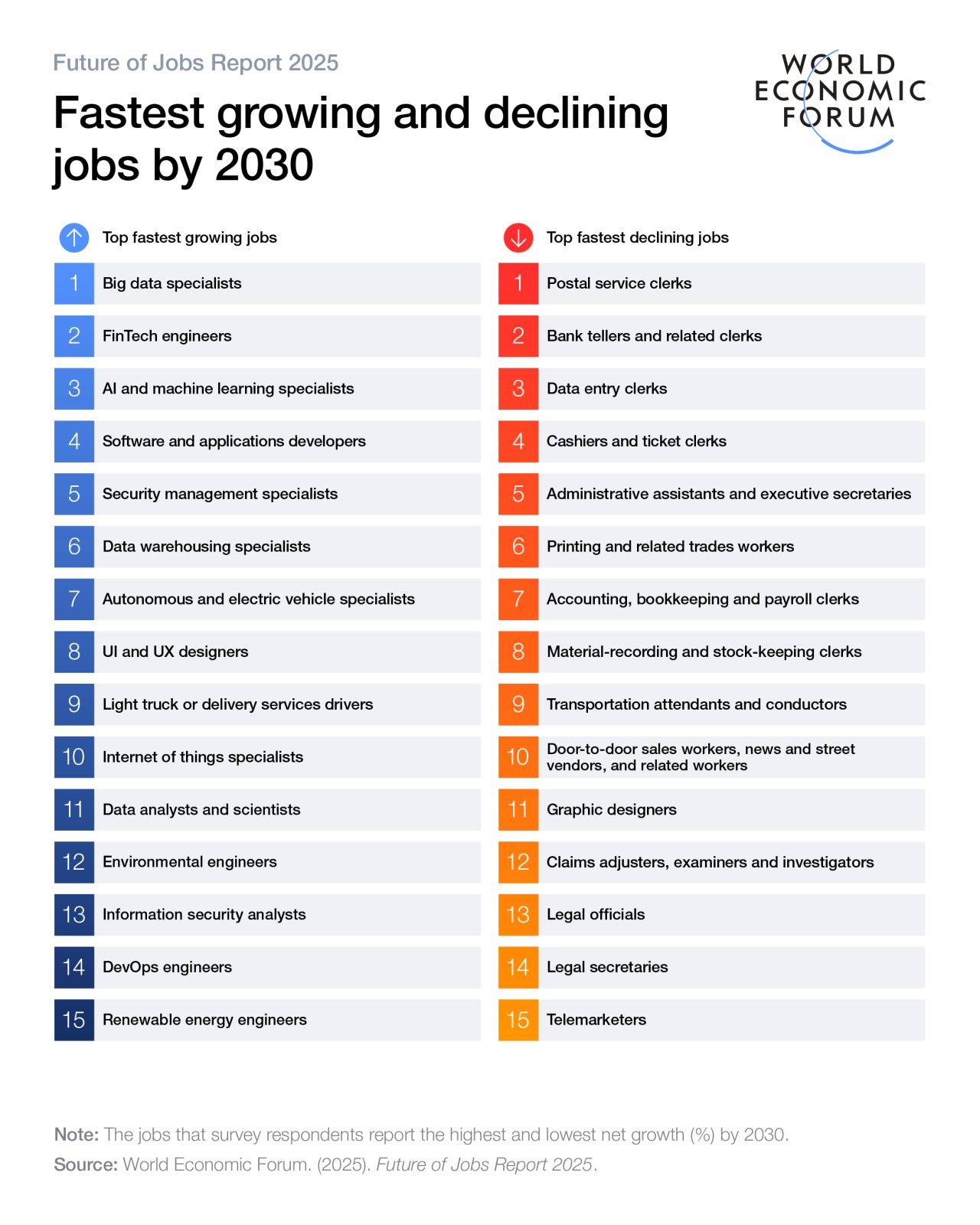

Technology-related roles are the fastest- growing jobs in percentage terms, including Big Data Specialists, Fintech Engineers, AI and Machine Learning Specialists and Software and Application Developers. Green and energy transition roles, including Autonomous and Electric Vehicle Specialists, Environmental Engineers, and Renewable Energy Engineers, also feature within the top fastest-growing roles.

Clerical and Secretarial Workers – including Cashiers and Ticket Clerks, and Administrative Assistants and Executive Secretaries – are expected to see the largest decline in absolute numbers. Similarly, businesses expect the fastest-declining roles to include Postal Service Clerks, Bank Tellers and Data Entry Clerks.

On average, workers can expect that two-fifths (39%) of their existing skill sets will be transformed or become outdated over the 2025-2030 period. However, this measure of “skill instability” has slowed compared to previous editions of the report, from 44% in 2023 and a high point of 57% in 2020 in the wake of the pandemic. This finding could potentially be due to an increasing share of workers (50%) having completed training, reskilling or upskilling measures, compared to 41% in the report’s 2023 edition.

Analytical thinking remains the most sought- after core skill among employers, with seven out of 10 companies considering it as essential in 2025. This is followed by resilience, flexibility and agility, along with leadership and social influence.

AI and big data top the list of fastest-growing skills, followed closely by networks and cybersecurity as well as technology literacy. Complementing these technology-related skills, creative thinking, resilience, flexibility and agility, along with curiosity and lifelong learning, are also expected to continue to rise in importance over the 2025-2030 period. Conversely, manual dexterity, endurance and precision stand out with notable net declines in skills demand, with 24% of respondents foreseeing a decrease in their importance.

While global job numbers are projected to grow by 2030, existing and emerging skills differences between growing and declining roles could exacerbate existing skills gaps. The most prominent skills differentiating growing from declining jobs are anticipated to comprise resilience, flexibility and agility; resource management and operations; quality control; programming and technological literacy.

Given these evolving skill demands, the scale of workforce upskilling and reskilling expected to be needed remains significant: if the world’s workforce was made up of 100 people, 59 would need training by 2030. Of these, employers foresee that 29 could be upskilled in their current roles and 19 could be upskilled and redeployed elsewhere within their organization. However, 11 would be unlikely to receive the reskilling or upkskilling needed, leaving their employment prospects increasingly at risk.

Skill gaps are categorically considered the biggest barrier to business transformation by Future of Jobs Survey respondents, with 63% of employers identifying them as a major barrier over the 2025- 2030 period. Accordingly, 85% of employers surveyed plan to prioritize upskilling their workforce, with 70% of employers expecting to hire staff with new skills, 40% planning to reduce staff as their skills become less relevant, and 50% planning to transition staff from declining to growing roles.

Supporting employee health and well-being is expected to be a top focus for talent attraction, with 64% of employers surveyed identifying it as a key strategy to increase talent availability. Effective reskilling and upskilling initiatives, along with improving talent progression and promotion, are also seen as holding high potential for talent attraction. Funding for - and provision of - reskilling and upskilling are seen as the two most welcomed public policies to boost talent availability.

The Future of Jobs Survey also finds that adoption of diversity, equity and inclusion initiatives remains on the rise. The potential for expanding talent availability by tapping into diverse talent pools is highlighted by four times more employers (47%) than two years ago (10%). Diversity, equity and inclusion initiatives have become more prevalent, with 83% of employers reporting such an initiative in place, compared to 67% in 2023. Such initiatives are particularly popular for companies headquartered in North America, with a 96% uptake rate, and for employers with over 50,000 employees (95%).

By 2030, just over half of employers (52%) anticipate allocating a greater share of their revenue to wages, with only 7% expecting this share to decline. Wage strategies are driven primarily by goals of aligning wages with workers’ productivity and performance and competing for retaining talent and skills. Finally, half of employers plan to re- orient their business in response to AI, two-thirds plan to hire talent with specific AI skills, while 40% anticipate reducing their workforce where AI can automate tasks.

Click here to download the report.

Global Macro Outlook 2025-26 Growth, inflation and interest rates to settle at lower, stable levels- Moody's Rating

The global economy has shown remarkable resilience in bouncing back from supply chain disruptions during a pandemic, an energy and food crisis as the Russia-Ukraine war began, high inflation and consequent monetary policy tightening. Most G-20 economies will experience steady growth and continue to benefit from policy easing and supportive commodity prices. However, postelection changes in US (Aaa negative) domestic and international policies could potentially accelerate global economic fragmentation, complicating ongoing stabilization. The aggregate and net effects of trade, fiscal, immigration and regulatory policy changes will expand the range of outcomes for countries and sectors.

G-20 economies will post steady but differentiated growth rates. We forecast the G-20 economies will grow by 2.8% in 2024, down from 3.0% in 2023 and moderate through 2026. The US economy is outperforming other advanced economies, though its growth will likely decelerate despite the strong momentum. Europe's sluggish recovery will gradually firm. China 's (A1 negative) growth will likely slow even as stimulus measures are implemented. Rising trade protectionism and a push in several large economies to strengthen domestic industries makes external demand a less reliable source of growth.

Increased trade tensions and geopolitical stresses are primary risks to the macro outlook. The inclusion of North Korean soldiers by Russia in Ukraine (Ca stable), rising tensions in the South China Sea and the Taiwan Strait and expanding conflicts in the Middle East contribute to a tense international backdrop. Competition between the US and China will shape policies, potentially raise global trade barriers and trigger trade or currency wars. This long-term geoeconomic fragmentation could further split the global economy into geopolitical blocs, complicating global trade and financial connectedness, further dampening global growth.

Reductions in global policy interest rates will end in 2025. We expect core inflation will decline to near central bank targets by mid-2025, facilitating movement of policy rates toward neutral stances. Synchronized easing will help bolster economic stability but at least some of this may be countered by heightened risks to US inflation from policies proposed by the incoming administration of Donald Trump. We expect the Fed will adopt a cautious approach to policy normalization.

Change in US administration injects greater policy induced uncertainty. The new US administration will inherit an economy with surprising strength but for forecasting purposes we assume that the net effect of policies will exert a small drag on economic activity. Other than that, we do not account for changes to fiscal, immigration or trade policies until they are implemented.

Click here to download the report.

Business Ready 2024

Business Ready (B-READY) 2024 report assesses the regulatory framework and public services directed at firms, and the efficiency with which regulatory framework and public services are combined in practice. Mauritius scores highest in Labor, Business Entry, and International Trade. Within these areas, the economy implemented good practices in its labor dispute resolution mechanisms, unique business identifiers for business transactions and regulatory interactions, and a legal framework for international trade in goods and services consistent with good practices. Mauritius scores lowest in Utility Services, Dispute Resolution, and Market Competition. Within these areas, the economy lacks regulations for equal access to internet infrastructure and robust regulations to encourage competition for internet carriers, it underperforms with regards to public services in mediation, and lags in the digitalization of intellectual property services.

Click here to download the report.

OECD Investment Policy Reviews: Mauritius 2024

This review assesses the climate for domestic and foreign investment in Mauritius. It discusses the challenges and opportunities faced by the government in its reform efforts. Capitalising on the OECD Policy Framework for Investment and the OECD Foreign Direct Investment Qualities Policy Toolkit, this review explores trends and qualities in foreign investment, development successes and productivity challenges, investment policy, investment promotion and facilitation, and investment incentives. The review highlights potential reform priorities to help Mauritius fulfil its development ambitions that align with its commitment to comply with the principles of openness, transparency and non discrimination. This report also helps Mauritius, as a new Adherent to the OECD Declaration on International Investment and Multinational Enterprises, to promote greater investment policy transparency, as well as responsible business conduct.

While Mauritius has experienced impressive economic development, some of the past drivers of growth described above, including favourable demographics, structural transformation, and capital accumulation may be more difficult to rely upon in the future. The so-called middle-income trap – which has been experienced by many countries that struggle to sustain the kind of growth previously experienced as they approach high income status – requires the adoption of new approaches to growth and development . Higher productivity will be needed to continue to raise incomes.

Higher rates of productivity growth will be needed to support continued increases in income in Mauritius. Value added per worker is just a quarter that of the OECD average. Mauritian labour productivity, measured as GDP per person employed, is well below the average for OECD member countries, but well above its regional average and also above the average for its income group. Total factor productivity, which measures output unexplained by capital or labour inputs, is also between that of upper middle- and high-income countries in key sectors such as food and textiles, but below both in the garments sector (World Bank, 2021[27]). Labour productivity growth has been declining. Between 2000 and 2019 (excluding the effects of the pandemic), value added per worker grew by 3.3%, but annual productivity growth slowed over this period.

Setting priorities for productivity growth Improving productivity growth will require that Mauritius further build upon its established strengths regarding foreign investment, innovation and skills, and inclusiveness. It will be important to diversify the sources of FDI inflows and better leverage the opportunities they present for local businesses, including in improving export prospects. Greater emphasis on innovation and skill development will also support the expansion of new areas of economic activity and greater competitiveness for local firms. Alongside these efforts, more attention will need to be paid to fostering stronger growth that addresses inequality, including through the expansion of opportunities for SMEs.

Click here to download the report.

External trade – 2nd Quarter 2024

Total Exports

Total exports (inclusive of ship's stores & bunkers) for the second quarter of 2024 were valued at Rs 29,579 million, showing an increase of 17.6%, compared to the corresponding quarter of 2023. This is mainly explained by increases in the exports of “Ships' stores & bunkers" (+91.4%), “Food and live animals" (+9.0%) and “Manufactured goods classified chiefly by material" (+0.1%), partly offset by decreases in the exports of “Machinery and transport equipment" (-12.9%), “Miscellaneous manufactured articles" (-6.2%) and “Chemicals and related products n.e.s" (-1.4%). Compared to the previous quarter, the total exports for second quarter of 2024 increased by 26.6%.

For the first semester of 2024, total exports valued at Rs 52,938 million increased by 4.5%, compared to Rs 50,660 million in the corresponding period of 2023.

Total Imports

Total imports, for the second quarter of 2024, amounted to Rs 76,712 million showing an increase of 5.6%, compared to the corresponding quarter of 2023. This is mainly due to increases in imports of “Mineral fuels, lubricants and related materials" (+40.4%) and “Chemicals and related products n.e.s" (+12.6%), partly offset by decreases in the imports of “Beverages and tobacco" (-39.3%), “Miscellaneous manufactured articles" (-6.5%), “Manufactured goods classified chiefly by material" (-2.7%), “Food and live animals" (-2.1%) and “Machinery and transport equipment" (-0.7%). Compared to the previous quarter, the total imports for the second quarter of 2024 increased by 10.5%.

Balance of trade

The trade deficit for the second quarter of 2024 worked out to Rs 47,133 million, 2.4% higher than the deficit of Rs 46,048 million of the previous quarter and 0.8% lower than the deficit of Rs 47,493 million of the corresponding quarter of 2023.

For the first semester of 2024, the trade deficit worked out to around Rs 93,181 million, 6.4% higher than the deficit of Rs 87,592 million in the first semester of 2023.

Forecast for year 2024

Based on trends and information from various sources, the forecast for year 2024 for both total exports and total imports have been maintained at the previous forecast figures.

Total exports for 2024 will be around Rs 104 billion, same level as year 2023. Total imports for 2024 including one-off items such as machinery for metro terminals, will be around Rs 300 billion, 5.6% higher than the total imports of around Rs 284 billion in 2023. The trade deficit for 2024 is forecasted at around Rs 196 billion, 8.9% higher as compared to around Rs 180 billion in 2023.

Click here to download the report.

Impact of COVID-19 and the Russia-Ukraine crisis on micro small and medium-size enterprises(MSMEs)in Mauritius

MSMEs play a vital role in the development pathway of the Mauritian economy. The MSME sector contributes to both increased output and productivity as well as job creation. They also act as a catalyst in restructuring and diversifying further the productive base of the economy and help in the industrialization process of the country. The COVID-19 pandemic and the Russia-Ukraine crisis have had important effects on Micro, Small and Medium sized Enterprises (MSMEs). Being a category that remains highly vulnerable to shocks, MSMEs have been, and sometimes irreversibly, affected by both shocks. In fact, as MSMEs were starting to recover gradually and slowly from the pandemic in 2022, they were faced with additional shocks namely the Russia-Ukraine crisis with ripple effects. While COVID-19 primarily disrupted global supply chains and had a direct impact on sectors like tourism and manufacturing, the Russia-Ukraine crisis had more indirect effects on the cost structure of Mauritian MSMEs due to rising oil and transportation costs. To mitigate these challenges, MSMEs in Mauritius had to adapt to the changing global economic landscape, explore alternative sourcing options, and diversify their product offerings. Government support, including financial aid and policy adjustments, played a crucial role in helping these businesses navigate the complex challenges posed by both the pandemic and the war. In essence both crises have impacted the Mauritian economy in different ways, thus the objective of this study is to assess the impact of both COVID-19 and the current Russia-Ukraine crisis on MSMEs in Mauritius. The study specifically assesses the impacts on MSMEs’ ease to produce, trade and to do business and identify new opportunities to enhance their resilience and competitiveness as they move forward especially opportunities through trade (e.g., AfCFTA, etc.) and technology and innovation.

Click here to download the report.

World Economic Outlook Update July 2024

Global growth is projected to be in line with the April 2024 World Economic Outlook (WEO) forecast, at 3.2 percent in 2024 and 3.3 percent in 2025.

Services inflation is holding up progress on disinflation, which is complicating monetary policy normalization. Upside risks to inflation have thus increased, raising the prospect of higher for even longer interest rates, in the context of escalating trade tensions and increased policy uncertainty. The policy mix should thus be sequenced carefully to achieve price stability and replenish diminished buffers.

Click here to download the report.

Travel & Tourism Development Index 2024

Created in collaboration with the University of Surrey and with input from leading Travel & Tourism (T&T) stakeholder organizations, thought leaders and data partners, the TTDI measures the set of factors and policies that enable the sustainable and resilient development of T&T.

The T&T sector’s post-pandemic growth continues, but its recovery has been mixed and operating conditions have been challenging.

In general, the Europe and Asia-Pacific regions and high-income economies in particular continue to have the most favourable conditions for T&T development

T&T enabling conditions in developing economies continue to improve, but far more is needed to close the sector-enabling gap.

Increasing ICT readiness and pandemic-era business and labour policies benefit T&T, but more progress is needed on areas such as workforce resilience and equality.

T&T resources, particularly natural and cultural assets, offer developing economies an opportunity for tourism-led economic development.

Despite progress, balancing growth with sustainability remains a major problem for the T&T sector.

Sub-Saharan Africa (Africa) has shown the most substantial enhancement in TTDI performance since 2019 (+2.1%), with 16 out of the 19 regional economies covered by the index increasing their TTDI scores. The sector’s potential to drive socioeconomic prosperity makes it an essential tool for development. In 2024, the region had the highest score for T&T Socioeconomic Impact, with the T&T industry in Africa generating, on average, over 21% more jobs for each direct position than the TTDI mean, and with an average of over 43% of the sector workforce employed in segments that are considered relatively high wage.

South Africa (55th) ranks the highest in the region and is home to its largest T&T economy. Meanwhile, Mauritius (57th) and Ghana (106th) rank the highest in Eastern and Western Africa, with the former also being the region’s most T&T dependent economy in 2022. Côte d’Ivoire has shown the greatest improvement in TTDI score (+6.4%, 116th to 114th)

Click here to download the report.

Designing for Education with Artificial Intelligence: An Essential Guide for Developers

Today and in the future, a growing array of Artificial Intelligence (AI) models and capabilities will be incorporated into the products that specifically serve educational settings.The U.S. Department of Education (Department) is committed to encouraging innovative advances in educational technology (edtech) to improve teaching and learning across the nation’s education systems and to supporting developers as they create products and services using AI for the educational market. Building on the Department’s prior report, Artificial Intelligence and the Future of Teaching and Learning: Insights and Recommendations (2023 AI Report), this guide seeks to inform product leads and their teams of innovators, designers, developers, customer-facing staff, and legal teams as they work toward safety, security, and trust while creating AI products and services for use in education. This landscape is broader than those building large language models (LLMs) or deploying chatbots; it includes all the ways existing and emerging AI capabilities can be used to further shared educational goals.

Click here to download the report.

The Top 10 Emerging Technologies of 2024

The Top 10 Emerging Technologies of 2024 are:

1. AI for scientific discovery: While artificial intelligence (AI) has been used in research for many years, advances in deep learning, generative AI and foundation models are revolutionizing the scientific discovery process. AI will enable researchers to make unprecedented connections and advancements in understanding diseases, proposing new materials, and enhancing knowledge of the human body and mind.

2. Privacy-enhancing technologies: Protecting personal privacy while providing new opportunities for global data sharing and collaboration, “synthetic data” is set to transform how information is handled with powerful applications in health-related research.

3. Reconfigurable intelligent surfaces: These innovative surfaces turn ordinary walls and surfaces into intelligent components for wireless communication while enhancing energy efficiency in wireless networks. They hold promise for numerous applications, from smart factories to vehicular networks.

4. High-altitude platform stations: Using aircraft, blimps and balloons, these systems can extend mobile network access to remote regions, helping bridge the digital divide for over 2.6 billion people worldwide.

5. Integrated sensing and communication: The advent of 6G networks facilitates simultaneous data collection (sensing) and transmission (communication). This enables environmental monitoring systems that help in smart agriculture, environmental conservation and urban planning. Integrated sensing and communication devices also promise to reduce energy and silicon consumption.

6. Immersive technology for the built world: Combining computing power with virtual and augmented reality, these technologies promise rapid improvements in infrastructure and daily systems. This technology allows designers and construction professionals to check for correspondence between physical and digital models, ensuring accuracy and safety and advancing sustainability.

7. Elastocalorics: As global temperatures rise, the need for cooling solutions is set to soar. Offering higher efficiency and lower energy use, elastocalorics release and absorb heat under mechanical stress, presenting a sustainable alternative to current technologies.

8. Carbon-capturing microbes: Engineered organisms convert emissions into valuable products like biofuels, providing a promising approach to mitigating climate change.

9. Alternative livestock feeds: protein feeds for livestock sourced from single-cell proteins, algae and food waste could offer a sustainable solution for the agricultural industry.

10. Genomics for transplants: The successful implantation of genetically engineered organs into a human marks a significant advancement in healthcare, offering hope to millions awaiting transplants.

Click here to download the report.

Fostering Effective Energy Transition INSIGHT REPORT JUNE 2024

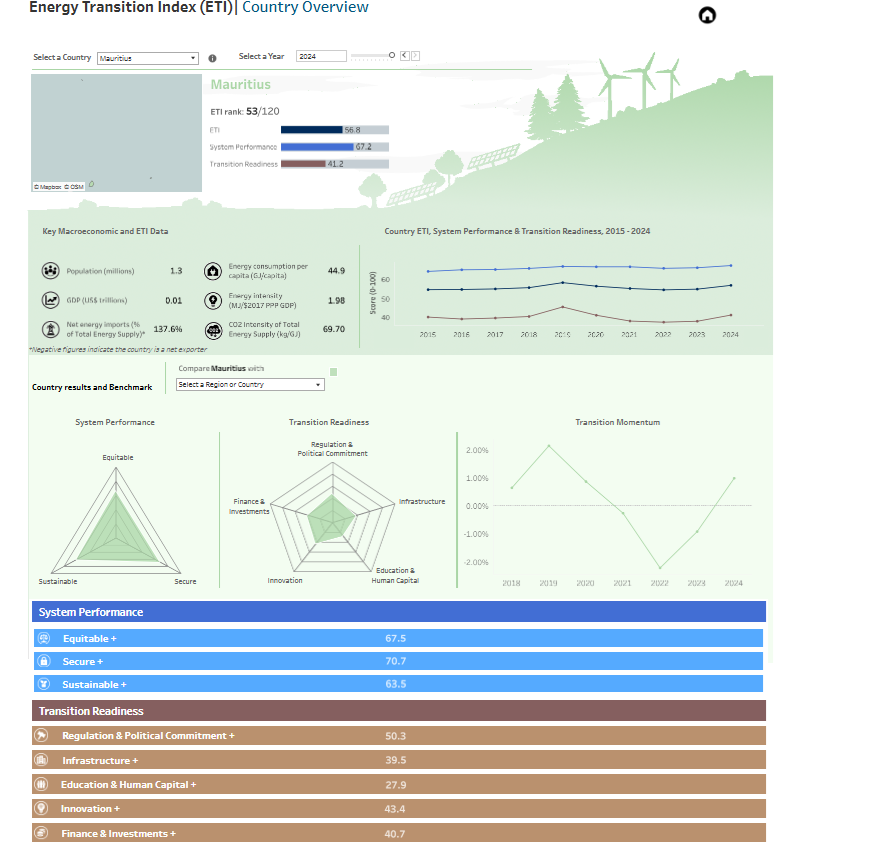

The energy transition is progressing but has lost momentum in the face of increasing global uncertainty, according to the World Economic Forum's Fostering Effective Energy Transition 2024 report. The Energy Transition Index (ETI), which benchmarks 120 countries on their current energy system performance and on the readiness of their enabling environment, finds that while there has been notable progress in energy efficiency and a marked increase in the adoption of clean energy sources, energy transition momentum has been held back by setbacks in energy equity, driven by rising energy prices in recent years. Energy security also continues to be tested by geopolitical risks.

Click here to download the report.

Global Gender Gap Report 2024

𝗧𝗵𝗲 𝗹𝗮𝗰𝗸 𝗼𝗳 𝗺𝗲𝗮𝗻𝗶𝗻𝗴𝗳𝘂𝗹, 𝘄𝗶𝗱𝗲𝘀𝗽𝗿𝗲𝗮𝗱 𝗰𝗵𝗮𝗻𝗴𝗲 𝘀𝗶𝗻𝗰𝗲 𝘁𝗵𝗲 𝗹𝗮𝘀𝘁 𝗲𝗱𝗶𝘁𝗶𝗼𝗻 𝗲𝗳𝗳𝗲𝗰𝘁𝗶𝘃𝗲𝗹𝘆 𝘀𝗹𝗼𝘄𝘀 𝗱𝗼𝘄𝗻 𝘁𝗵𝗲 𝗿𝗮𝘁𝗲 𝗼𝗳 𝗽𝗿𝗼𝗴𝗿𝗲𝘀𝘀 𝘁𝗼 𝗮𝘁𝘁𝗮𝗶𝗻 𝗽𝗮𝗿𝗶𝘁𝘆. 𝗕𝗮𝘀𝗲𝗱 𝗼𝗻 𝗰𝘂𝗿𝗿𝗲𝗻𝘁 𝗱𝗮𝘁𝗮, 𝗶𝘁 𝘄𝗶𝗹𝗹 𝘁𝗮𝗸𝗲 𝟭𝟯𝟰 𝘆𝗲𝗮𝗿𝘀 𝘁𝗼 𝗿𝗲𝗮𝗰𝗵 𝗳𝘂𝗹𝗹 𝗽𝗮𝗿𝗶𝘁𝘆 – 𝗿𝗼𝘂𝗴𝗵𝗹𝘆 𝗳𝗶𝘃𝗲 𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝘀 𝗯𝗲𝘆𝗼𝗻𝗱 𝘁𝗵𝗲 𝟮𝟬𝟯𝟬 𝗦𝘂𝘀𝘁𝗮𝗶𝗻𝗮𝗯𝗹𝗲 𝗗𝗲𝘃𝗲𝗹𝗼𝗽𝗺𝗲𝗻𝘁 𝗚𝗼𝗮𝗹 (𝗦𝗗𝗚) 𝘁𝗮𝗿𝗴𝗲𝘁.

The global gender gap score in 2024 for all 146 countries included in this edition stands at 68.5% closed. Compared against the constant sample of 143 countries included in last year’s edition, the global gender gap has been closed by a further +.𝟭 percentage point, 𝗳𝗿𝗼𝗺 𝟲𝟴.𝟱% 𝘁𝗼 𝟲𝟴.𝟲%. When considering the 101 countries covered continuously from 2006 to 2024, the gap has also improved +.1 points and reached 68.6%.

Click here to download the report.

Climate Change in the Indian Mind

This report is based on findings from a nationally representative survey of adults (18+) in India conducted by the Yale Program on Climate Change Communication (YPCCC) and the Centre for Voting Opinion & Trends in Election Research (CVoter). Interview dates: September 5, 2023 – November 1, 2023. Interviews: 2,178 adults. Average margin of error: +/- 2.1 percentage points at the 95% confidence level.

Click here to download the report.

International Monetary Fund - World Economic Outlook April 2024

The baseline forecast is for the world economy to continue growing at 3.2 percent during 2024 and 2025, at the same pace as in 2023. A slight acceleration for advanced economies—where growth is expected to rise from 1.6 percent in 2023 to 1.7 percent in 2024 and 1.8 percent in 2025—will be offset by a modest slowdown in emerging market and developing economies from 4.3 percent in 2023 to 4.2 percent in both 2024 and 2025. The forecast for global growth five years from now—at 3.1 percent—is at its lowest in decades. Global inflation is forecast to decline steadily, from 6.8 percent in 2023 to 5.9 percent in 2024 and 4.5 percent in 2025, with advanced economies returning to their inflation targets sooner than emerging market and developing economies. Core inflation is generally projected to decline more gradually.

Click here to download the report.

Africa's Impulse - An Analysis of Issues Shaping Africa's Economic Future

African Economies Projected to Grow by 3.4 % in 2024, But Faster and More Equitable Growth Needed to Reduce Poverty.

The report underscores that despite the projected boost in growth, the pace of economic expansion in the region remains below the growth rate of the previous decade (2000-2014) and is insufficient to have a significant effect on poverty reduction. Moreover, due to multiple factors including structural inequality, economic growth reduces poverty in Sub-Saharan Africa less than in other regions.

Click here to download the report.

World Happiness Report 2024

In this issue of the World Happiness Report we focus on the happiness of people at different stages of life. In the seven ages of man in Shakespeare’s As You Like It, the later stages of life are portrayed as deeply depressing. But happiness research shows a more nuanced picture, and one that is changing over time. In the West, the received wisdom was that the young are the happiest and that happiness thereafter declines until middle age, followed by substantial recovery. But since 2006-10, as we shall see, happiness among the young (aged 15-24) has fallen sharply in North America – to a point where the young are less happy than the old. Youth happiness has also fallen (but less sharply) in Western Europe.

By contrast, happiness at every age has risen sharply in Central and Eastern Europe, so that young people are now equally happy in both parts of Europe. In the former Soviet Union and

East Asia too there have been large increases in happiness at every age, while in South Asia and the Middle East and North Africa happiness has fallen at every age.

Click here to download the World Happiness Report 2024.

Clicl here to download the Mauritius Ranking.